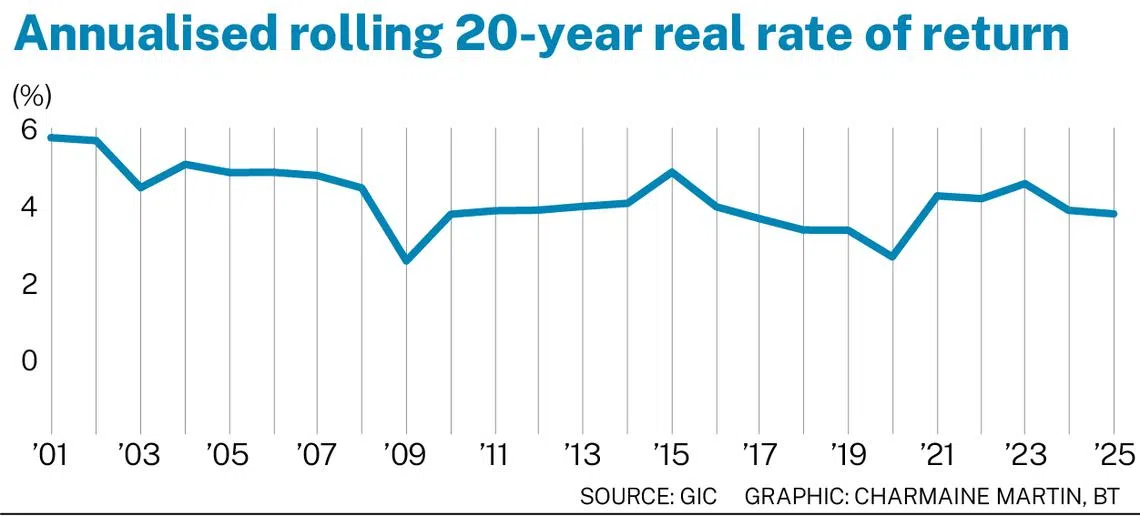

GIC posts 3.8% 20-year annualised real rate of return; expects returns ahead will be more volatile

[SINGAPORE] Sovereign wealth fund GIC reported an annualised rolling 20-year real rate of return of 3.8 per cent for its latest period ended Mar 31, 2025.

This rate of return – which accounts for inflation and spans the 20-year period from April 2005 to March 2025 – is down 0.1 percentage point from the 3.9 per cent recorded in the previous year, GIC said on Friday (Jul 25).

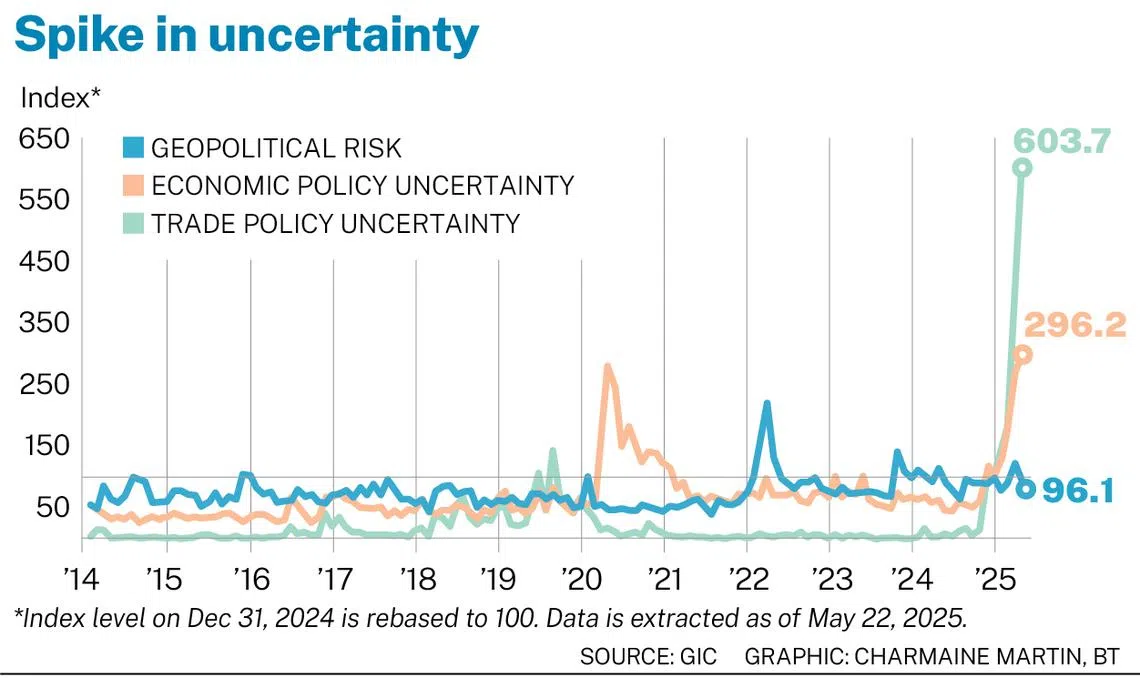

“The forces shaping today’s investment environment go beyond any market cycle or structural trend. They strike at the foundations of the global order. They are rewriting the rules of global investing,” said Lim Chow Kiat, chief executive of GIC.

Bryan Yeo, GIC’s group chief investment officer, added: “There are many forces in the world today driving unprecedented uncertainty that are intensifying, and the truth is, it’s harder to prepare for.”

Cyclically, there is a more volatile growth and inflation environment.

Structural shifts – such as demographic changes and a reconfiguration of global supply chains – will affect capital flows, productivity and projected long-term returns.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

There are also multi-year foundational shifts in areas including climate change, artificial intelligence (AI), great power conflict, heightened protectionism and deglobalisation.

As a result, Yeo expects returns to be more volatile in the next decade amid the more fragmented environment, and be more widely dispersed across different markets and within asset classes.

“This means that the compensation for taking additional market risks we expect will likely be lower, given higher starting valuations,” added Yeo, who took over from Jeffrey Jaensubhakij on Apr 1, 2025.

To tackle these challenges, Yeo noted three main investment approaches: diversifying with intent, granularity, and agility.

“Diversification has to be very deliberate,” he said. “It is critical in providing the GIC total portfolio with the robustness and the resilience, given the wide-ranging outcomes.”

Granularity enables GIC to dig deep and find good, bottom-up opportunities, Yeo said.

“(It) is about looking two, three layers deeper and being deliberate about how it allocates and reinvest proceeds from divestments,” he said.

For example, opportunities vary widely within broad themes like AI or climate change, so these need to be broken down into investible segments for investments to be more targeted.

As for agility, a strong liquidity position would keep GIC’s portfolio flexible, he added.

GIC also noted some bright spots, from greater stimulus measures from Europe and China, and technological developments around AI, which may boost productivity growth.

Portfolio mix

The annualised nominal rate of return, which does not account for inflation, was 5.7 per cent in US dollar terms for the 20-year period.

Nominal return was 5 per cent for the 10-year period, and 6.1 per cent for the five-year period in US dollar terms.

With GIC’s portfolio mix broken down, the share of equities rises to 51 per cent in FY2025, from 46 per cent the year before.

Correspondingly, the share of fixed income falls to 26 per cent, from 32 per cent in FY2024.

The share of real assets is stable at 23 per cent, from 22 per cent.

The US continues to be GIC’s largest market in terms of capital deployment.

Commenting on the impact of US trade policies on these assets, Lim said tariffs are just one of many variables or forces affecting companies.

Other variables need to be considered, he said, citing technology shifts and AI adoption.

Yeo added that GIC continues to see strong innovation in the US, which is a key characteristic of companies that can create and generate long-term value creation.

When asked about the US dollar’s weakness, Lim said he is “not particularly concerned about individual currency exposures” despite the US dollar making up a significant part of this exposure, as the portfolio is diversified along many dimensions, including currencies.

“GIC’s goal is to beat global inflation, so almost by definition, we have to have a global basket of exposure along many dimensions,” he said.

Meanwhile, several US companies derive revenue from overseas, and would benefit from translation effects if the dollar weakens, Yeo said.

“So we have to look more granularly and think hard about what the impact might be on the underlying investments,” he said.