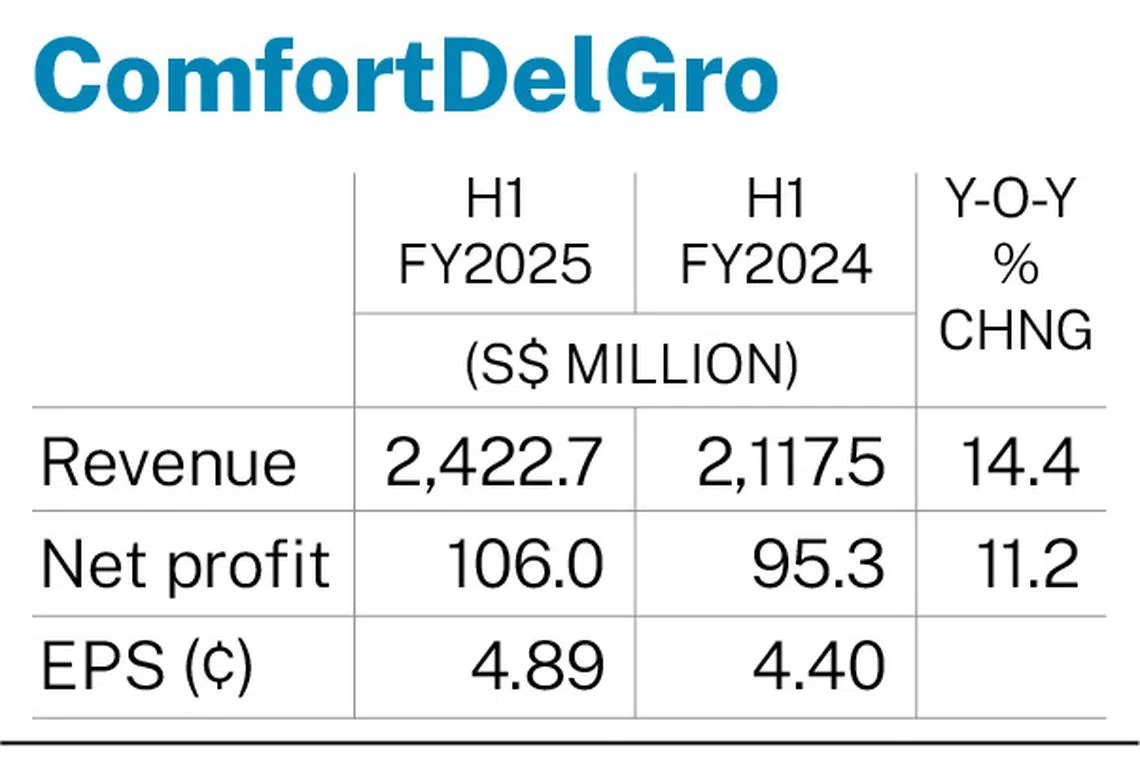

ComfortDelGro’s H1 2025 earnings rise 11.2% to S$106 million

[SINGAPORE] Transport operator ComfortDelGro (CDG) reported on Wednesday (Aug 13) an 11.2 per cent increase in earnings for the first half of 2025 to S$106 million, from S$95.3 million in the year-ago period.

Revenue for the period rose 14.4 per cent to S$2.4 billion, from S$2.1 billion in the year prior, due to contributions from its overseas revenue, which contributed more than half of its total revenue for the first time.

Overseas revenue contributions, which amounted to S$1.3 billion, increased to 54.3 per cent of the overall revenue, up from 46.3 per cent in the year-ago period.

Full-year contributions from its acquisitions of UK private-hire service Addison Lee, UK-based ground transport management specialist CMAC, and Australian taxi network A2B in 2024 helped boost CDG’s overseas operating profit by 67.8 per cent compared with a year ago.

Revenue from Singapore, on the other hand, dipped slightly by 2.6 per cent to S$1.1 billion over the same period.

Earnings per share for H1 2025 was up 11.1 per cent at S$0.0489, from S$0.044 in H1 2024.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Revenue from the public-transport business rose 29.6 per cent to S$1.6 billion in H1 2025, from S$1.5 billion in H1 2024, due to increased revenues from renewals of its UK bus contract at improved margins, as well as the commencement of its four bus franchises in Greater Manchester.

For its taxi and private-hire segment, revenue rose to S$519.7 million, rising 58.7 per cent from S$327.5 million a year ago.

However, operating costs for this segment also increased by 67.5 per cent – from S$265.9 million in H1 2024 to S$445.4 million in H1 2025.

As for its other private-transport segment, revenue for H1 stood at S$214.5 million, up 23.6 per cent, from S$173.5 million a year ago.

Overall operating profit for H1 grew to S$172.5 million, or 22.8 per cent higher than S$140.5 million from a year ago.

Cheng Siak Kian, the group chief executive officer of CDG, said that the increase in overseas earnings reflects CDG’s focus on pursuing profitable international growth.

“The international public transport business continues to do well, underpinned by our ability to collaborate effectively with our clients to deliver valued services to support their transport goals,” he said.

Outlook

In terms of business outlook for Singapore, CDG said that rail revenue is projected to increase with a steady growth in ridership, although manpower costs are anticipated to rise in a tight labour market.

As for its overseas markets, the company expects the renewal of its London public bus contracts to continue at improved margins. It also noted that the driver shortage in Australia is slowly reducing.

“Although the group has no direct exposure to recently introduced trade tariffs, with recent geopolitical and trade tensions, the group continues to monitor foreign exchange and interest rates closely and take appropriate measures as necessary while continuing to execute its strategy,” it added.

An interim dividend of S$0.0391 per share was declared by the board, to be paid on Aug 28.

Shares of CDG closed 0.6 per cent or S$0.01 higher at S$1.58 on Wednesday, before the announcement.