‘Not the marriage we expected’: analysts surprised by Simba’s acquisition of M1

[SINGAPORE] The surprising union of M1 and Simba Telecom has left StarHub behind its competitors, analysts said.

The deal defied industry expectations of a StarHub-led consolidation, with Paul Chew from Phillip Securities noting that the market consensus was that M1 would be sold to StarHub.

The merger will now cause StarHub to fall to third place in Singapore’s mobile market, noted Chris Muckensturm in a Bloomberg Intelligence report released on Monday (Aug 11).

Shares of StarHub dived 4.9 per cent or S$0.06 to close at S$1.16 on Monday.

Missed opportunity for StarHub

Muckensturm noted StarHub’s low 1.26 times net-debt to earnings before interest, tax, depreciation and amortisation (Ebitda) meant that it was ready for a mobile or enterprise-related merger and acquisition, likely with M1.

In April, Bloomberg said that the merger would have seen StarHub’s sales jump 50 per cent by 2026, far exceeding the consensus’ 3 per cent, noting that a shift towards consumer segment offers timely protection amid global uncertainty.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

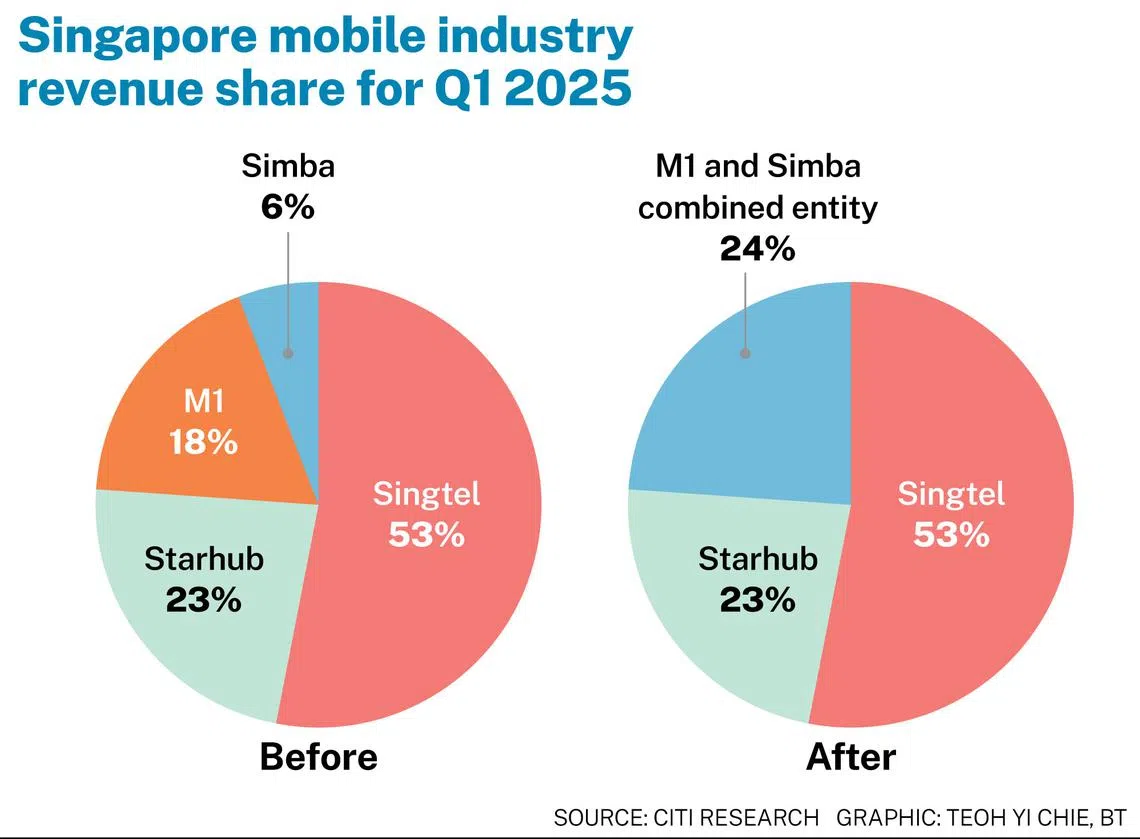

A Citi report noted that assuming the merger is complete, Simba’s revenue share will rise from its current 6 per cent to 24 per cent, making it on a par with StarHub’s 23 per cent revenue share.

“With consolidation likely to restore pricing discipline, StarHub is poised to stem a decade-long mobile average revenue per user (ARPU) decline,” added Muckensturm.

Simba a clear winner

“Simba likely faces potential merger synergy gains owing to operational duplications with M1,” Citi said, adding that it was “not the marriage we expected”.

The report noted that Simba had driven price competition, which was ultimately rooted in the drive to scale.

“In order for a telco to turn profitable, it needs to drive revenue share and scale,” the report added.

“Eight years from its licensing, we estimate Simba has generated just 6 per cent revenue share in the industry as incumbent operators have reacted with aggressive pricing tactics,” the report added. As a result, Simba struggled to drive meaningful market shares.

Chew added that Simba may have been concerned that a lack of 5G infrastructure could hinder its growth and future cost structure.

When asked about the 7.3 times enterprise value/Ebitda ratio, Chew said that it is “within industry valuations”.

Telco industry the real winner

Chew said that on paper, three operators is naturally better than four operators.

“Consolidation is a positive, regardless of who partners up,” added Citi.

Since the licensing of Simba in 2016, Citi estimates, the mobile industry has lost approximately S$700 million in revenue till the end of 2024, due to competition.

This has significantly reduced profitability for the industry, as demonstrated by M1 and StarHub’s profit contraction over the period, added Citi.

Drawing similarities from other similar industry trends in Indonesia, Thailand, the Philippines and India, Citi believes that market consolidation will lead to market repair for the following years, citing accelerating industry growth.

“This follows market defragmentation which in turn serves to reduce competitive intensity,” the report added.

However, Muckensturm insisted that StarHub is still well positioned.

“Despite the setback, StarHub’s pivot towards enterprise solutions, which are set to account for 50 per cent of 2025 revenue, positions the carrier for the next economic upturn,” her report added.

Citi rated StarHub as a “buy”, and set the target price of StarHub at S$1.43, assuming a 5 per cent yield.