Paragon Reit posts 10.4% lower H2 DPU of S$0.0233

THE manager of Paragon Real Estate Investment Trust (Paragon Reit) on Tuesday (Feb 11) posted a distribution per unit (DPU) of S$0.0233 for the second half ended December, down 10.4 per cent from S$0.026 in the previous corresponding period.

This brings FY2024 DPU, excluding special distribution, to S$0.0465, down 7.4 per cent from S$0.0502 previously.

The H2 distribution of S$0.0233 will be paid on Mar 28, after the record date of Feb 19.

Including a special distribution of S$0.0185 that was paid to unitholders in October 2024, DPU for the second half would have risen 60.8 per cent on the year to S$0.0418. DPU for FY2024 would have also been 29.5 per cent higher at S$0.065.

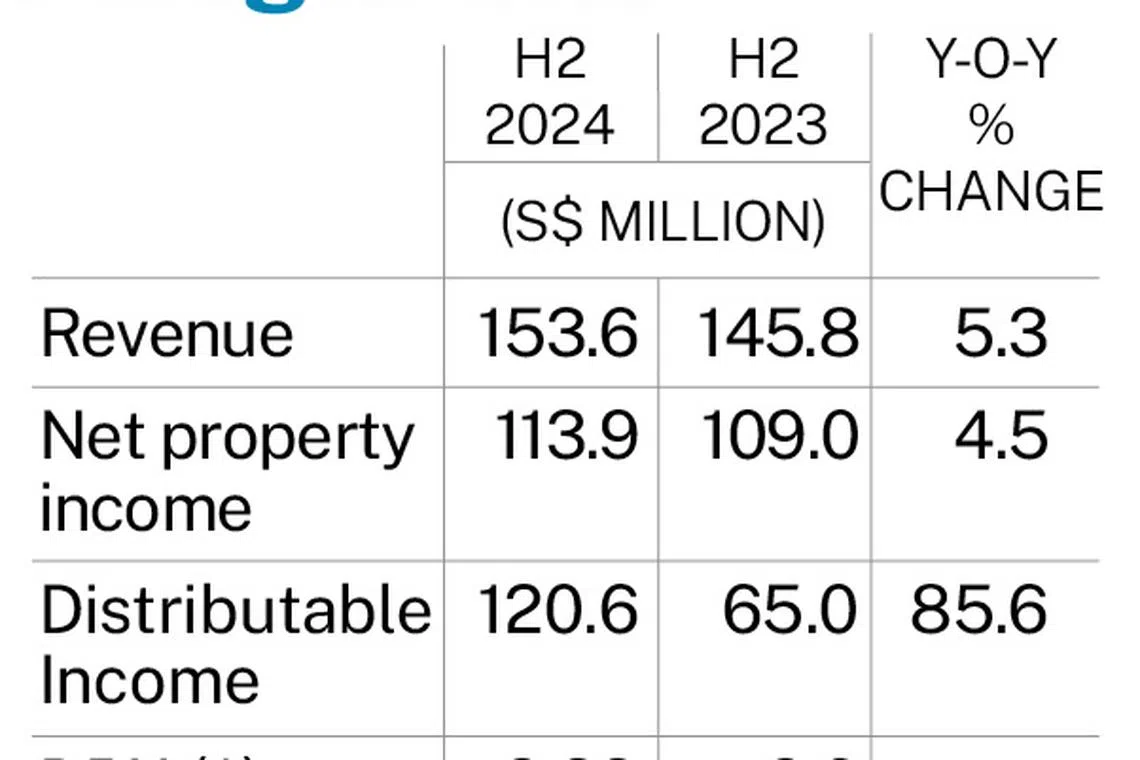

Distributable income rose 85.6 per cent to S$120.6 million for H2, from S$65 million in the same period the year before.

Revenue was up 5.3 per cent to S$153.6 million for the half-year period, from S$145.8 million in the year-ago period, mainly due to positive rental reversions in the Reit’s Singapore assets.

BT in your inbox

Start and end each day with the latest news stories and analyses delivered straight to your inbox.

Net property income (NPI) grew 4.5 per cent to S$113.9 million for the half-year period, from S$109 million in the year before. Property operating expenses, however, were up 7.8 per cent on higher property tax, marketing expenses and insurance.

For the full year, distributable income rose 33.5 per cent to S$181 million, from S$135.6 million in FY2023. Revenue was up 4.2 per cent at S$301 million, while NPI was up 4.5 per cent at S$224.7 million.

As at Dec 31, 2024, the Reit’s portfolio occupancy stood at 97.5 per cent. Its weighted average lease expiry, excluding Figtree Grove, was 4.8 years by net lettable area as at end-December and 2.8 years by gross rental income.

Figtree Grove is a shopping centre in Wollongong, a coastal city in Australia. Paragon Reit’s manager in November last year entered into an agreement to sell its stake in the shopping mall for A$192 million (S$168 million). The divestment was completed on Jan 31, 2025.

The number of renewals or new leases signed for the Reit’s Singapore assets amounted to 169 as at end-December. This comprises 120 leases from Paragon and 49 from Clementi Mall.

Tenant sales at Paragon fell 5.4 per cent on the year to S$654.2 million in FY2024, while those of Clementi Mall rose 7.4 per cent on the year to S$268.2 million.

The valuation of Paragon as at end-2024 was 6.3 per cent higher at S$2.9 billion, while Clementi Mall’s valuation was up 5.9 per cent at S$645 million. Capitalisation rates across the two assets remained unchanged.

As for the Reit’s Australia assets, the number of renewals or new leases signed amounted to 102, with 90 coming from Westfield Marion Shopping Centre and 12 from Figtree Grove. Tenant sales at Westfield Marion rose 1.9 per cent, while those at Figtree Grove increased 1.3 per cent over the 12-month period.

Net asset value per unit as at Dec 31, 2024, was up 3.2 per cent at S$0.938. However, net asset value per unit would be S$0.915, excluding H2 distribution.

The Reit’s gearing as at end-December stood at 35.3 per cent with a weighted average term to maturity of 1.8 years. Some 70 per cent of its debt is fixed and average cost of debt stood at 4.4 per cent.

The manager intends to “continually optimise” the tenant mix of its properties and implement asset enhancement initiatives and proactive marketing plans.

It also plans on exploring investment opportunities that will “add value to the Reit’s portfolio and improve returns to unitholders”.

But the manager also cautioned that macroeconomic uncertainties are likely to remain elevated in the near term as the market anticipates how the new US administration will address immigration, tariffs and tax cuts.

Units of Paragon Reit ended Monday 0.6 per cent or S$0.005 lower at S$0.89, before the Reit manager called for a trading halt on Tuesday morning.